Company Update / Banks / IJ / Click here for full PDF version

Author(s): Anthony ; Jovent Muliadi

- 1Q24 net profit of Rp860bn (+7% yoy) came below at 22% of estimates amid weak PPOP (+2% yoy) despite benign provision (-12% yoy).

- NIM contracted by -20bp yoy amid steep increase in CoF. It now guides for lower FY24F NIM of 3.8% (vs. c.4% initially).

- Overall asset quality was stable qoq with LAR at 21.6% in 1Q24 vs. 24.2/21.1% in 1Q23/4Q23. Maintain Buy with unchanged TP.

1Q24 results: below on weak PPOP

posted 1Q24 net profit of Rp860bn (+7% yoy), below at 22% of our/consensus estimates. This was attributed to weak PPOP growth (+2% yoy) amid tepid NII growth (+3% yoy) and rising opex (+9% yoy). It expects non-II (+15% yoy) to remain strong throughout the year backed by treasury transaction and recovery on top of potential bulk asset sale (2x this year; total Rp2tr). Concurrently, provision dropped -12% yoy and brought CoC to 0.8% vs. 1/1.2% in 1Q23/FY23, though it guides for FY24F CoC of 1.1-1.2% which implies higher provision in subsequent quarters.

Lower NIM due to steep increase in CoF

NIM contracted to 3.3% vs. 3.5/3.8% in 1Q23/FY23 due to steep increase in CoF (+60bp yoy/+50bp qoq) but was offset by higher LDR of 96% (vs. 94/95 in 1Q23/4Q23). It guides for lower FY24F NIM of 3.8% due to higher for longer rate expectation (initially at c.4%). Deposit grew by +12% yoy (+2% qoq) as TD growth (+17% yoy/+11% qoq) outpaced (+7% yoy/-5% qoq).

Strong loan growth backed by all segments

Loan grew by +15% yoy (+3% qoq) mainly supported from mortgage growth of +12% yoy (+3% qoq). Moreover, non-housing loan also posted robust growth of +46% yoy (+5% qoq) driven by corporate loan at +56% yoy (+2% qoq). Despite the strong loan growth, kept its FY24F loan growth unchanged at 10-11%.

Stable asset quality

NPL was flattish qoq at 3% while SML increased +120bp qoq to 9.1%. Concurrently, LAR stood at 21.6% in 1Q24 vs. 24.2/21.1% in 1Q23/4Q23 with LAR coverage of 21.3% in 1Q24 vs. 21.3/22.1% in 1Q23/4Q23.

Maintain Buy with unchanged TP amid attractive valuation

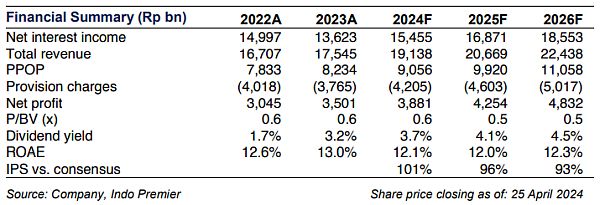

Maintain our Buy rating with unchanged TP of Rp1,750. is currently trading at 0.6x FY24F P/B and 4.9x P/E (vs. 10Y average of 0.8x and 7x). Risk is NIM compression amid higher for longer rate expectation.

Sumber : IPS